Embracing the small number of women in the automotive industry, Torqata continues to value women with automotive and tire industry experience, bringing three new experienced women in 2023, and promoting another to Vice President.

Huntersville, NC, March 31, 2023 — Torqata Data & Analytics, a software company in the tire industry, welcomes Kirsten Zaremba, Ashley Hoyt, and Kate Beirowski to the team, bringing additional experienced women into the automotive industry. Torqata also congratulates Elizabeth (Liz) Schneider on her new promotion to Vice President of Product.

Kirsten is on board as the new Director of Marketing, bringing more than 25 years’ experience in the automotive industry supporting the automotive aftermarket, dealers, and vehicle manufacturers, such as Volkswagen. Among the key initiatives while at the Auto Care Association, she led efforts to ensure secure and direct access to vehicle data with the “Your Car. Your Data.” campaign and Right to Repair. In addition, she is a Women in Auto Care member, on the Wheel and Tire Council for SEMA, and an Ambassador of TechForce.

Ashley joins as the newly created Senior Manager of Business Development and Partnerships, bringing on more than ten years’ of experience. Along with her childhood roots in the automotive industry, she is an experienced partnership manager. Most recently, she created the Enterprise CSM team at RepairPal, a software company for auto repair and maintenance, and defined the team’s mission and recruitment goals. In addition, she is a member of Women in Auto Care and YANG.

With more than ten years’ experience as an inspirational sales leader in the logistics and automotive industries, Kate joins Torqata as the Director of Inside Sales. She has built successful sales teams from the ground up and will bring that success to Torqata as we continue to grow and transform the tire industry. In addition, she is a member of Women in Auto Care.

It is with great pride that we announce the recent promotion of Liz Schneider to Vice President of Product. Liz joined Torqata in 2021 as the Product Area Manager, and has been a considerable part of Torqata’s success and growth in her previous role. She has more than 25 years of experience in the financial industry in various roles serving retail, small business, and commercial clients. Leveraging data to enable better customer experiences that drive revenue and deliver efficiencies has been at the heart of every role she’s had. In her new role with Torqata as the VP of Product, Liz will continue to lead her teams to meet their strategic goals and contribute to Torqata’s success.

“The uniqueness of every team member here at Torqata, combined with their knowledge and expertise in the industry, will help Torqata to, as we say, drive better decisions,” said Tim Eisenmann, CEO of Torqata Data and Analytics, “We celebrate equity and encourage women of the industry to continue to lead and pioneer our efforts. We’re proud of our new additions and promotion to Team Torqata!”

About Torqata

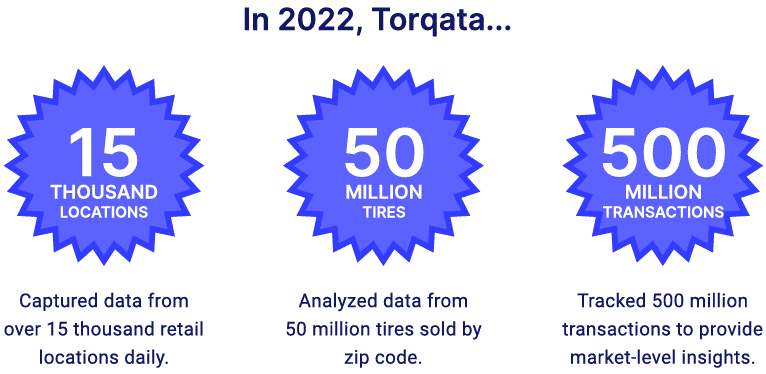

Torqata Data & Analytics is a data analytics software company that helps tire manufacturers, distributors and retailers maximize profits and customer value by providing data visibility and connectivity across the supply chain. Torqata offers a full suite of data-driven software tools for pricing, inventory management, and sales insights designed to streamline operations and reduce or eliminate stale inventory. This allows manufacturers, distributors, and retailers to improve key areas of their business performance using patented technologies, and data-driven analytics and insights.

Torqata’s vision is to enable and inform manufacturers, distributors, service, and tire shop owners to source, price, and optimize their inventory; this reduces waste and drives profits through the entire distribution channel.

Interested individuals and organizations can visit Torqata.com to schedule a demonstration or to learn more.

Media Contact

Kirsten Zaremba

Torqata Data & Analtyics

kzaremba@torqata.com